Credit cards are financial tools that allow users to make purchases and payments in installments, without the need to have the money available at the time. Although they can be very useful in certain situations, they also have their disadvantages and it is important to be aware of them before deciding to use them.

Pros

- Ease of payment: Credit cards allow you to make purchases without having to have cash on hand at the time.

- Accumulation of points and rewards: Many cards offer points and rewards programs for frequent use, which can be exchanged for discounts, trips, gifts, among others.

- Consumer protection: Credit cards offer consumer protection in case of fraud or unauthorized charges.

- Improved credit history: Responsible use of credit cards can improve the cardholder's credit history, which can be useful for future loan or credit applications.

Convenience and ease of use

One of the main advantages of using credit cards is the convenience and ease of use they offer. With a credit card, there is no need to carry cash at all times, which can be very convenient in situations such as travel or online shopping.

In addition, credit cards are often equipped with security and fraud protection systems, giving the user greater peace of mind. It is also possible to make payments in installments or deferred payments, which can be useful for unforeseen expenses or for acquiring higher value goods.

However, it is important to bear in mind that excessive use of credit cards can lead to an accumulation of debts and long-term financial difficulties. It is therefore advisable to use it responsibly and to control the expenses incurred with it.

Fraud protection

One of the main advantages of using credit cards is fraud protection. In case someone steals or misuses your card, most credit card companies offer fraud protection and will reimburse you for the money lost.

Also, if you make purchases online, credit cards offer an additional layer of security. Many websites require you to enter your credit card number to make a purchase, but they do not have access to your personal or financial information.

It is important to keep in mind that you should take steps to protect your financial information when using credit cards, such as not sharing your card number with anyone and regularly reviewing your statements for suspicious activity.

Opportunity to accumulate points and earn rewards

One of the most attractive advantages of using credit cards is the possibility of accumulating points or miles that can be redeemed for rewards, such as travel, electronics, store discounts, among others. This can be especially beneficial for those who frequently use their credit card to make purchases.

However, it is important to keep in mind that some cards may have higher interest rates or membership fees that can negate the benefits gained by accumulating points. It is important to read the terms and conditions carefully before applying for a credit card with rewards programs.

Cons

- They can generate high interest rates if the balance is not paid in full each month.

- Excessive use can lead to increased debt and a lowered credit rating.

- Some cards may have hidden fees, such as cash advance fees or balance transfer fees.

- Credit card fraud is common and can be difficult to detect and resolve.

- Rewards and benefits may be limited or not worthwhile if the card is not used frequently.

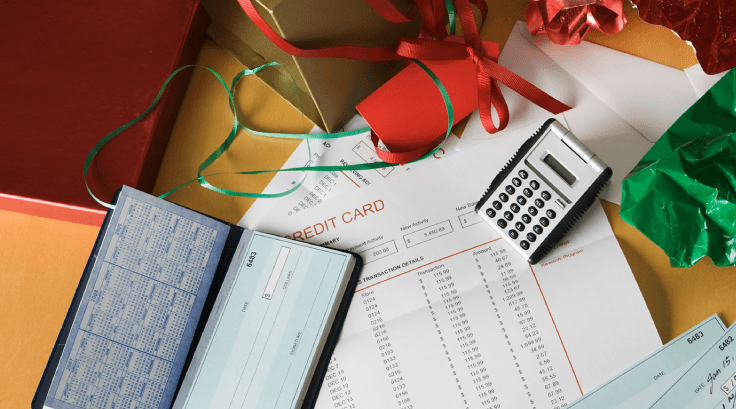

High Interest Rates and Late Fees

One of the most significant disadvantages of using credit cards is the high interest rates they often carry. Failure to pay the balance in full each month can result in interest charges that quickly add to the debt. In addition, if a late payment is made or the credit limit is exceeded, late fees can also be applied, which further increase the balance.

Possibility of falling into unsustainable debt

One of the biggest risks of using credit cards is the possibility of falling into unsustainable debt. Many people are tempted to spend beyond their means because they do not feel the immediate impact on their budget. However, high interest rates and late fees can add up quickly, turning a small debt into an overwhelming financial burden.

To avoid this problem, it is important to use credit cards responsibly and not spend more than you can afford each month. It is also advisable to compare the different options available and choose a card with reasonable interest rates and fees.

Risk of theft of personal and financial information

One of the biggest risks when using credit cards is the theft of personal and financial information. Fraudsters can obtain this information through methods such as phishing, skimming or hacking.

Phishing is a technique in which fraudsters send fake e-mails that appear to come from legitimate financial institutions, requesting personal and financial information from the recipient.

Skimming is a method in which fraudsters place devices on ATMs or payment terminals to collect the user's card and PIN information.

Hacking is when fraudsters gain unauthorized access to databases containing personal and financial information.

To reduce the risk of information theft, it is important to take steps such as regularly reviewing your account transactions, not sharing your personal or financial information with anyone, and using anti-virus software to protect your computer and mobile devices.