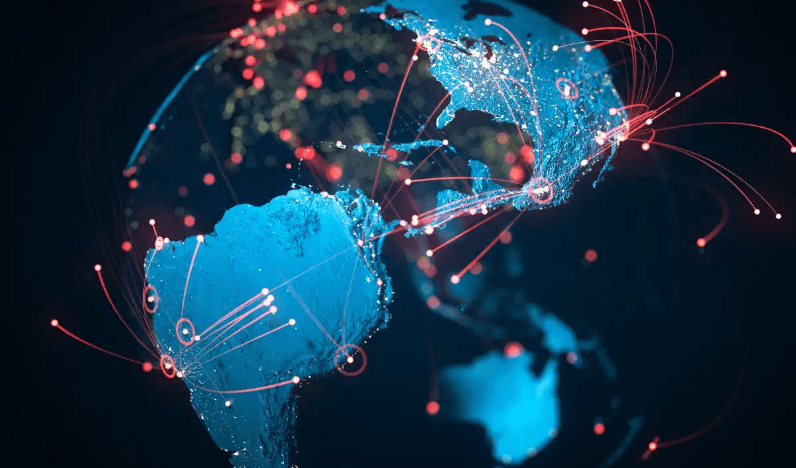

Investing in international assets is an increasingly popular strategy as a form of diversification, so much so that it is used by investors around the world.

International allocation can help lower investment risks, increase return potential, and take advantage of opportunities in global markets.

In fact, whatever your goal, the financial market offers numerous possibilities for investment diversification.

Even more so because an event in the Brazilian scenario or even a national crisis tends not to affect the results of these investments, especially with everything our economy has been going through.

How to make an international allocation?

Understand your investment strategy

Before you start investing in international assets, it is important to understand your overall investment strategy.

This includes your risk tolerance, investment goals, time horizon, and asset allocation.

A well-defined strategy will help you choose the right investments and avoid costly mistakes.

Choose the right markets

Not all international markets are created equal. Some are more stable, while others are more volatile.

Some have strong sectors that you may want to invest in, while others may have economies that are in a growth phase.

When choosing international markets, it is important to consider your risk profile, as well as the country's economic and political conditions.

Consider the local currency

Fluctuating exchange rates can significantly affect the returns on your international investments.

Therefore, it is important to consider the local currency when choosing your investments.

If you are investing in a foreign market, you may consider using financial products that are linked to that currency, such as exchange traded funds or ETFs.

Diversify your investments

Diversification is one of the most important rules of asset allocation.

When investing in international assets, it is important to diversify your portfolio by choosing investments in different markets and sectors.

Be aware of costs and taxation

When investing in international assets, it is important to be aware of the associated costs, such as brokerage commissions, currency conversion fees, and taxes.

Make sure you fully understand all the costs involved and choose a brokerage company that offers competitive rates.

Not to be forgotten

Investing in international assets can be an effective strategy to diversify your portfolio and increase your return potential.

It is important to understand your investment strategy, choose the right markets, consider local currency, diversify your investments, and be aware of costs and taxation.

By following these tips, you can reap the benefits of international allocation intelligently and effectively.